In today’s world, most groups spread their activities abroad and logically different members of the group operate in different currencies.

Is the consolidation process of combining the financial statements of two (or more) companies different when they operate in different currencies?

If you want to combine the financial statements prepared in different currencies, you will still follow the same consolidation procedures.

You still need to eliminate the share capital and pre-acquisition profits of a subsidiary with parent’s investment in a subsidiary (plus recognize any goodwill and/or non-controlling interest).

You still need to eliminate intragroup balances and transactions, including unrealized profits on intragroup sales and any dividends paid by a subsidiary to a parent.

So what’s the issue here?

You guessed it – you can’t combine apples and pears because it makes no sense.

Therefore, BEFORE you start performing the consolidation procedures, you need to translate the subsidiary’s financial statements to the parent’s presentation currency.

We need to follow the rules in IAS 21 The Effects of Changes in Foreign Exchange Rates for translating the financial statements to a presentation currency.

Just a small note: please, do not mess up a functional currency with a presentation currency.

Every company has just ONE functional currency, but it can present its financial statements in MANY presentation currencies.

While the functional currency depends on the economic environment of a company and its specific operations, the presentation currency is a matter of CHOICE.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

For example, take some UK company. Its functional currency is in most cases GBP (exceptions exist), but this company can decide to prepare its financial statements in EUR or USD – they will be the presentation currencies.

What rates should we use to translate the financial statements in a presentation currency?

I’ve summarized in in the following table:

| What? | When? | What rate? |

| Assets and liabilities | Current period (20X1) | Closing rate (20X1) |

| Comparative period (20X0) | Closing rate (20X0) | |

| Equity items | Current and comparative period | Not specified – see below |

| Income and expenses (P/L and OCI) | Current period (20X1) | Actual rates or average in 20X1 |

| Comparative period (20X0) | Actual rates or average in 20X0 | |

| Exchange rate difference | CTD (currency translation difference) = separate component in equity | |

Please note that the above table applies when neither functional nor presentation currency are that of a hyperinflationary economy.

Actual rates are the rates at the date of the individual transactions, but you can use the average rate for the year if the actual rates do not differ too much.

Why is there a CTD?

If you translate the financial statements using different foreign exchange rates, then the balance sheet would not balance (i.e. assets will not equal liabilities plus equity).

Therefore, CTD, or currency translation difference arises – it’s a balancing figure and shows the difference from translating the financial statements in the presentation currency.

If you translate the financial statements to a presentation currency for the purpose of consolidation, you need to be careful with certain items.

It’s true that the standard IAS 21 is silent on this matter. No rules.

Some time ago, the exposure draft proposed to translate the equity items at the closing rate, but it was not included in the standard.

It means that in most cases, companies decide whether they apply closing rate or historical rate. However, they need to be consistent.

In my own past practice, I’ve seen both cases – closing rates and historical rates, too.

What works the best?

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

Let me describe what’s the most appropriate in my opinion, but please remember, that it results from the practice and common sense, not from the rules (as there are none).

For the share capital, the most appropriate seems to apply the historical rate applicable at the date of acquisition of the subsidiary by the parent, rather than the historical rate applicable when the share capital was issued.

The reason is that it’s easier and logical to fix the rate at the date of the acquisition when the goodwill and/or non-controlling interest are calculated.

For example, let’s say that the German company was established on 10 September 2010 with the share capital of EUR 100 000.

Then, on 3 January 2015, the German company was acquired by the UK company.

The exchange rates were 0,8234 GBP/EUR on 10 September 2010, and 0,78 GBP/EUR on 3 January 2015.

When the UK parent translates German financial statements to GBP for the consolidation purposes, the share capital will be translated at the historical rate applicable on 3 January 2015.

Therefore, the share capital amounts to GBP 78 000, rather than GBP 82 340.

If the equity balances result from the transactions with shareholders (for example, share premium), then it’s appropriate to apply the historical rate consistently with the rate applied for the share capital.

If the equity balances result from income and expenses presented in OCI (e.g. revaluation surplus), then it’s more appropriate to translate them at the rate at the transaction date.

Intragroup receivables and payables are translated at the closing rate, as any other assets or liabilities.

Many people assume that exchange differences on intragroup receivables or payables should NOT affect the consolidated profit or loss.

In fact, they do affect profit or loss, because the group has some foreign exchange exposure, doesn’t it?

Let me illustrate again.

UK parent sold goods to the German subsidiary for GBP 10 000 on 30 November 2016 and as of 31 December 2016, the receivable is still open.

The relevant exchange rates:

At the date of transaction, German subsidiary recorded the payable at EUR 11 730 (10 000/0,8525).

On 31 December 2016, German subsidiary translates this monetary payable by the closing rate in its own financial statements. Be careful – this is the translation of a foreign currency payable to a functional currency, hence nothing to do with the consolidation.

Re-translated payable amounts to EUR 11 680 (10 000/0,8562) and the German subsidiary records the foreign exchange gain of EUR 50:

When the German company translates its financial statements to a presentation currency, then the intragroup trade payable of EUR 11 680 is translated to GBP using the closing rate of 0,8562 – so, it amounts to GBP 10 000 (11 680*0,85618).

You can eliminate it with the UK parent’s receivable of GBP 10 000.

However, there will still be exchange rate gain of EUR 50 reported in the subsidiary’s profit or loss. It stays there and it will become a part of a consolidated profit or loss, because it reflects the foreign exchange exposure resulting from foreign trade.

Here, let me warn you about the exception. When monetary items are a part of the net investment in the foreign operation, then you need to present exchange rate difference in other comprehensive income and not in P/L.

Let’s illustrate again.

Imagine the same situation as above. The only difference is that there was no intragroup sale of inventories.

Instead, the UK parent provided a loan to the German subsidiary of GBP 10 000. Let’s say that the settlement of the loan is not likely to occur in the foreseeable future and therefore, the loan is a part of the net investment in a foreign operation.

On the consolidation, the exchange rate gain of EUR 50 recorded in the German financial statements in profit or loss needs to be reclassified in OCI (together with the difference that arises on translation of the EUR 50 by the average rate).

With regard to profit or loss items, or intragroup sales – you should translate them at the date of a transaction if practical. If not, then apply the average rates for the period.

What about the provision for unrealized profit?

Here, IAS 21 is silent again, but in my opinion, the most appropriate seems to apply the rate ruling at the transaction date. This is consistent with the US GAAP, too.

So, let’s say the German subsidiary sold the goods to the UK parent on 30 November 2016 for EUR 5 000. They remain unsold in the UK warehouse at the year-end. The cost of goods sold for the German subsidiary was EUR 4 500.

The profit shown in German books is the unrealized profit for the group (as the goods are unsold from the group’s perspective).

It is translated at the transaction date rate, i.e. 0,8525 GBP/EUR (30 Nov 2016).

At the reporting date (31 Dec 2016), the consolidated financial statements show:

Please note the little trick here. If the German subsidiary does NOT sell the inventories to the parent, but keeps them at its own warehouse – what would their amount for the consolidation purposes be?

You would need to translate them using the closing rate, isn’t it?

Therefore, their amount would be EUR 4 500 (German cost of sales) * 0,8562 (closing rate) = 3 853. This is different from the situation when they are in the UK’s books. Yes, that happens.

If a subsidiary pays a dividend to its parent, then the parent records the dividend revenue at the rate applicable when the dividend was DECLARED, not paid.

The reason is that the parent needs to recognize the dividend income when the shareholders’ right to receive it was established (and that’s the declaration date, not actual payment date).

The UK parent acquired a German subsidiary on 3 January 2015 when the subsidiary’s retained earnings amounted to EUR 4 000. On 30 November 2016, the UK parent purchased goods from the German subsidiary for EUR 5 000. All these goods were sold by the year-end and the payable was unpaid.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

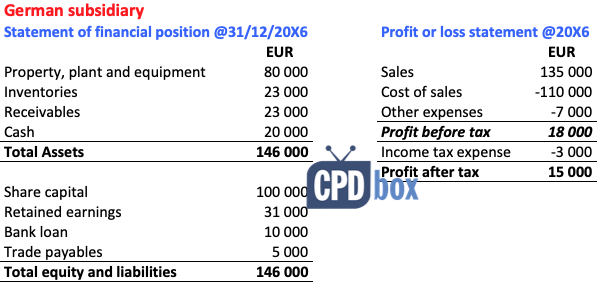

The financial statements of the German subsidiary at 31 December 2016:

Required: Translate the financial statements of the German subsidiary at 31 December 2016 in the presentation currency of GBP for the purposes of consolidation.

Before you start working on the translation, you should present the intragroup balances separately – please see the table below.

Also, I strongly recommend analyzing the retained earnings and equity items and present them separately as appropriate.

In this example, it’s appropriate to present the retained earnings by the individual years when they were generated, because you need to apply different rates to translate them.

Here, you should apply the acquisition date rate to the translation of pre-acquisition retained earnings, then the rate applicable in 2015 for 2015 profits, etc.

Please also note, that no rate was applied for the profit 2016 presented in the statement of financial position (under equity). The reason is that you simply transfer this profit from the statement of profit or loss.

The statement of financial position translated to GBP:

| EUR | Rate | GBP | ||

| Property, plant and equipment | 80 000 | Closing | 0,8562 | 68 496 |

| Inventories | 23 000 | Closing | 0,8562 | 19 693 |

| Receivables – intragroup | 5 000 | Closing | 0,8562 | 4 281 |

| Receivables – other | 18 000 | Closing | 0,8562 | 15 412 |

| Cash | 20 000 | Closing | 0,8562 | 17 124 |

| Total assets | 146 000 | 125 006 | ||

| Share capital | 100 000 | Acquisition date | 0,78 | 78 000 |

| Retained earnings – pre-acquisition | 4 000 | Acquisition date | 0,78 | 3 120 |

| Profit 2015 | 12 000 | From 2015 statements* | 0,7261 | 8 713 |

| Profit 2016 | 15 000 | From P/L statement | n/a | 12 451 |

| Currency translation difference (CTD) | n/a | Balancing figure** | n/a | 9 879 |

| Bank loan | 10 000 | Closing | 0,8562 | 8 562 |

| Trade payables | 5 000 | Closing | 0,8562 | 4 281 |

| Total equity and liabilities | 146 000 | 125 006 | ||

The statement of profit or loss translated to GBP:

| EUR | Rate | GBP | ||

| Sales – other | 130 000 | Average 2016 | 0,8188 | 106 444 |

| Sales – intragroup | 5 000 | Transaction date | 0,8525 | 4 263 |

| Cost of sales | -110 000 | Average 2016 | 0,8188 | -90 068 |

| Other expenses | -7 000 | Average 2016 | 0,8188 | -5 732 |

| Profit before tax | 18 000 | n/a | 14 907 | |

| Income tax expense | -3 000 | Average 2016 | 0,8188 | -2 456 |

| Net profit | 15 000 | n/a | 12 451 | |

Now, you should be able to tackle the foreign currency consolidation yourself.

Once you have translated the foreign currency balance sheet and the profit or loss statement (or OCI), you can apply the usual consolidation procedures (see the example here).

Let me just warn you about the statement of cash flows.

It’s a huge mistake to make the statement of cash flows based on the consolidated balance sheets– i.e. make differences in balances, classify them, make non-cash adjustments, etc.

Your cash flow figures would contain a lot of non-cash foreign exchange differences and that’s not right. Also, this is NOT permitted by IAS 21.

Instead, please follow these steps:

Here’s the video showing the full process step by step:

Questions? Comments? Please, leave a comment below this article. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

185 / 190please would anyone help me with how to consolidate financial position and comprehensive income of exchange rates with other solved examples apart from this one??

For Balance Sheet i understand we apply Closing FX rate, however, i am confused about presentation under the PPE (Fixed assets) schedule so my opening balance is at USD using prior year closing rate and during current year shall i update my Closing value using CY rate where will i show the difference under the PPE schedule. I have noticed in some instances the Value for Eg. for Land & Building is same as opening so that means they are not converted using the Closing rate.

Hi Silvia, this is such a great article.

To clarify, is it correct that regardless whether we translate the subsidiary’s Share Capital/Share Premium at historical rate or closing rate, the end result is the same, i.e. there will still be CTD arising? Either due to the sub’s BS not balancing if Share Capital and Premiums are translated at historical rate, or in the case of translating the Sub’s SC/SP at closing rate, the Parent’s investment in the Sub at historical rate will not equal to Sub’s SC/SP at closing rate?

Hi Silvia, Could you help me with a specific situation when consolidating some P&L items. Suppose we have a Parent and a Subsidiary. Parent receives from Subsidiary some interest on a loan given. Amount = 1000 USD.

Parent functional currency is EUR, Subsidiary functional currency is USD.

At the transaction date (USD/EUR rate = 0.815), Parent will record an income of 1000 x 0.815 = 815 EUR, and subsidiary will record an expense of 1000 USD.

When translating the amounts to consolidation reporting currency EUR, we will use the Average rate USD/EUR = 0.81.

Therefore Parent income = 815 EUR, and Subsidiary expense = 1000 x 0.81 = 810 EUR. This is an intercompany transaction so both sides should be eliminated. Since the amounts are not the same 815 ≠ 810, there will be a currency translation difference of 5 EUR.

My question will be, what happens and how do we compute the difference due to ICO transaction when the transaction currency amount are different. Parent records in it’s books an income of 1020 USD and Subsidiary records 990 USD. On which side should we rely when computing the difference? Thank you very much for your time

Hi Nicolae,

this situation is quite normal. Many people think that the impact should be zero, since this is in intragroup transaction, but the truth is that the cash really passes here and yes, there is some foreign currency risk expressed in this difference. What I would advise is to take a consistent approach. For example, you can translate intragroup amounts with the rate valid at the date of transaction (not the average rate) and eliminate as it goes – in this case, the difference appears in CTD basically. However, your aim is to eliminate as far as it goes, consistently (similar transactions in the same consistent way) and yes, there will always be the impact on P/L, so you would almost never eliminate at zero. I hope this helps.

Hi Silvia. Follow up to this topic: where do I report this difference generated between using “average rate” on one side and “actual transaction rate” on parent side in an intragroup transaction? For consolidation purposes and IC elimination purposes I am left with this difference however I am not sure if this is CTA to be reported in the equity or FX gain/loss to be reported in P&L. I sort of see it as a currency translation adjustment belonging to CTA and not a currency transaction adjustment as those coming from a re-valuation of monetary items in foreign currency.

Hi Silva, Thanks for your topic.

I need to advise from you/all of you for consolidated with associates (call “A”). We need to convert A’s FS to consolidation currency (GBP to USD).

Therefore, we will have translation for share capital, RE and profit/loss during the year. For consolidation purpose, we only book converted profit/loss during the year or combine with translation difference as I mentioned above.

Thank you in advance!

Dear Silvia

Thanks for the clear and concise explanations. What about non-controlling interest (NCI)? Are all transactions to be kept at historical rates, i.e. there will not be any adjustment of CTD to NCI? Thanks in advance.

Yoke

Hi Silvia

i have an issue with PP&E we will face a difference in PP&E in the Depreciation Expense which i used the annual Average rate and the Accumulated Depreciation which translated by the Closing rate , if i used the same rate for the Depreciation and The Accumulated i will find a difference in the Depreciation Expense or in Net PP&E in Balance sheet

Hi Ahmed, did you solve this issue? I am also wondering about this. Although the CTD will show the overall difference, including from the PP&E, the Fixed Asset note will not balance unless the relevant portion is stated in the note.

Dear Silvia,

One question: subsidiary of UK company is in Kazakhstan. Both have functional currency – USD. At which rate should Kazakh company translate its transactions into USD – at Kazakh national bank rate or Bank of England or any else? The rates of the same currencies vary greatly among national banks, which one should be taken? Of course, UK parent would like to use Bank of England’s rate for its subsidiary, but will it be ok for subsidiary’s standalone statements? Is there any info on that in standard?

Hi Silvia, your analysis has been thorough but at the same time simple to follow, thanks.

In your opinion, could it be advisable for a company with the USD as the functional currency and the local currency as the presentation currency, to translate RE to closing rate every year when the presentation currency suffers from continuous devaluation?

Otherwise, i.e. maintaining RE at every historical rate, shareholders could find very little to distribute in the future if they decide to keep RE in the company for some years (assuming only RE in local currency are distributable according to local regulations).

This case is not an invention of mine, but a reality in my country.

Thanks in advance!

Thank you, Silvia, for putting together everything in specific items to a presentation currency. I think you have covered all the major points in this article, I will share this with my network as well.

Hello SIr,

Post translation into GBP, the balancing figure is shown in Currency translation difference a/c. ?

Is this just a balancing figure without any corresponding affect ? I mean is it a single entry or double entry?

Hi Silvia I am facing a unique issue. We make a quarterly consolidation and in 1 quarter there is Profit in P&L statement in functional currency but loss appearing in presentation currency due to fluctuation in currency. We translate P&L items on monthly average whereas Balance sheet items at Clsoing rate. Equity & Other Reserves on historical rates. Please let me know how to deal in situations when profit in functional currency but loss in presentation currency.

Hi Silvia,

Really great article and website!

I’m having a bit of a brainteaser and think I know the answer but just wondering if I’m correct.

A parent of a wholly-owned sub has presentation and functional currency in CAD. The child’s functional currency is USD but it also transacts in CAD. The sub revalues the item to its functional currency in its standalone P&L, but then should the parent translate that gain or loss to the consolidated P&L or to AOCI? It’s just weird because let’s say the sub has A/R of $10M CAD /$8M USD, but then it revalues to $7M USD and books a $1M loss, when you translate back to CAD you should get back to the $10M CAD. So does the FX loss get consolidated?

Thank you!

Hi Gianni,

thanks! I think I explained in the article that yes, these gains and losses can arise on translating back and forth because this is the cost of making the international transactions. Best, S.

Hi Silvia

Thank you so much for the prompt reply. Yes I see it now, it was in the “intragroup balances” section but applies for any FX gain/loss in the subs books. The FX being translated and consolidated up to the parent’s P&L is what I was expecting. Thanks again!

Silvia, I have a question.

I work for a US Company (USD Functional Currency) with a Legal Entity in Brazil (BRL Functional Currency). In order to hedge the cash flow exposure of my Brazil Legal Entity I was thinking on following the steps below: Identify the Net USD Amount of Rev – COGS – Opex = Exposure and Hedge it. On this scenario, all BRL activities would be excluded, such as “Revenue from Sales and Salaries”. From a Brazil entity perspective it makes sense. From a US perspective I have my doubts. Comments / recommendations? Thx,

Lucas

Dear Silvia. Regarding dividends receivable and payable recorded in different currencies which give rise to exchange differences. Would the exchange differences be captured in OCI upon consolidation if these monetary assets form part of net investment in foreign operations? What happens if the dividends have been paid (realized) subsequent to reporting date? Do the exchange differences be transferred from OCI to income statement?

Dear Silvia, first I would like to thank you for detailed explanation. I have a question regarding rates which is correct to be used for re translation of equity into presentation currency for consolidation purposes. Above you have mention that IAS 21 does not say about it. And we can use either historical date rate or closing date rate (as I understand reporting date). Please advice.

Abdul Nabi Memon June 18, 2019 at 7:50 amThanks Silvia,

Cost of Sales includes closing inventory i.e. Cost of Sales = Opening Inventory + Purchase + Other Incidental Expenses – Closing Inventory.

If we translate all these items at Average Rate, then the value of closing inventory appearing in the balance sheet (statement of financial position) would differ from that appearing under Cost of Sales. So is this difference correct or the closing inventory while calculating cost of sales should be translated at Closing Rate. Please do reply if possible.

Of course there is a difference – the reason is that you are using the approximation (average rate) and there are also some closing rate differences within balance-sheet items. For the purpose of consolidation, you should simply calculate cost of sales in the functional currency and only then translate it by the average rate. S.

Hi Silvia,

This is an excellent article and you have explained it so simply and clearly. I needed to know the calculation for translation gain which is quite clear now.

Thanks and keep it up!

Hi Silvia, All good & clear. Now when consolidating, do you allocate the CTD to NCI as part of Equity in calculating the GW? Or how do you treat it please.

which rates apply for post acquisitions profits and impired good will ….. FRANCINE N'ZI-YAO October 18, 2018 at 6:57 pmHi Silvia, I have one question please on intragroups assets and liabilities. If a parent (EUR) receive a loan denominated in the functional currency of an affiliated (USD), Will we convert the loan in EUR (the presentation currency of the parent) and record the gain/loss at year-end related in the standalone accounts of the parent? My question arises with this example:

UK parent sold goods to the German subsidiary for GBP 10 000 on 30 November 2016 and as of 31 December 2016, the receivable is still open. The relevant exchange rates: 30 November 2016: 0,8525 GBP/EUR

31 December 2016: 0,8562 GBP/EUR

Parent co has invested CAD $10 million into a mutual fund on January 1 and is the only shareholder. The investment, which was made through a UK subsidiary, is in a US equity fund. The functional currency of the fund and the UK subsidiary are USD and GBP respectively. On January 1, the exchange rates are 1CAD = 1GBP = 1USD. During the year the fund’s net value appreciates by USD $5 million due to dividends of USD $2 million and market appreciation USD $3 million. Both the gains and dividends occur evenly over the course of the year. As the Fund is still relatively new, The parent remains the only investor in the Fund at year end. As at period end the exchange have moved and are now 1CAD = 0.5 GBP, 1 CAD = 0.75 USD and 1 GBP = 1.5 USD, the changes in rates have occurred evenly throughout the year. The Fund retains all income and does not pay a distribution. The UK subsidiary does not consolidate the mutual fund subsidiary due to the scope exemption in IFRS 10.4, and as a results a gain on the investment is recorded in the UK Sub. What are the CAD equivalent balances and results related to the investment in the mutual fund subsidiary which are included in the parents consolidated financial statements – please show balance sheet and comprehensive income?

Dear Ozar, well, this is really a long question to solve in the comments. These comments are better for quick and fast advices. We offer the online advisory service the IFRS Helpline where our top consultants can tackle similar questions – would you like me to send you more information?

Will a parent company that has currency translation differences in equity from preparing its financial statements in a presentation currency other than its functional currency be subject to the IFRS 1 exemptions and be able to reset them to nil?

Hi Silvia, For oversea subsidiary with paid-in capital, should this paid-in capital be translated at closing rate or historical rate?

Historical rateThere are no strict rules on this, but for more insight, see this article (search for Share capital in foreign currency).

Murira Kamau July 17, 2018 at 2:42 pmHi Silvia,

Your analysis is quite informative. My question is, for property plant and equipment, what translation rate should I take for items of property plant and equipment that were there as an opening balance for continuing consolidations?

If you are translating the financial statements to presentation currently, you always use closing rate, also for PPE. But it is actually said in the article – revise the first table.

Hi Mam,

I would like to know which exchange rate we have to use for translation of opening retained earnings of the component entity prepared in foreign currency to the presentation currency. Is it average rate of previous year or closing rate of previous year?

Thanks in advance

Hi Silvia, this article is amazing! Explanations and examples are very clear and useful. I’m going to buy the IFRS kit.

Thanks!

Hi Silvia,

How to choose presentation current for consolidated financials, can it be different from local current of the parent company.

Thanks.

Hi Bharath,

yes, it can be totally different from any functional currency that a subsidiary or a parent might have. In fact, you can select more than one presentation currency, based on your goals. For example, you would need to present your financials to the stock exchange in USD, but you also have a loan from European bank and they require your financials in EUR. And let’s say that your functional currency is INR – in this case, you can present financial statements in 2 presentation currencies (USD and EUR), despite the fact that they are both different from your functional currency (INR).

Hi Silvia, thank you for the explanation. May I ask what happens when a subsidiary changed its functional currency to be the same as that of the parent’s? What happens to the currency translation reserves that has been recognised in the past to balance the balance sheet? Thank you

Hi Silvia,Hello Silvia,

on this topic I have one question, what about the differences of foreign exchanges resulted from translation of fair value reserve recognized at OCI in the consolidation of foreign subsidiary, should we record that difference with CTD or with fair value reserve at OCI.

Hi Silvia! Though most of the questions that came to my mind got answered when went through the extremely simple explanation, i have one question i.e., ” If a co., has a subsidiary (Non-integral foreign operation), what rate will the holding co., use to eliminate profit in the inventory lying at subsidiary, Historical or closing rate?

Thanks in advance!

Hi Vikram,the most exact method is to do it with the historical rate. You can as well use the average rate method, but it’s approximation. Closing rate – no way 🙂 S.

Ashish GUpta November 23, 2017 at 6:29 amM Silvia, I have read Current Rate Method which is used for translation. Whether it comes from paragraph 39 of IAS 21?

Regarding the translation of equity items, if we use the closing rate, then we will be dividing whole Balance Sheet with the same rate eventually leading to differences only due to Retained earnings. Is this approach consistent with IAS 21?

Ashish, I did not use closing rate, but historic rate for translating equity. Also, please read above in the article – IAS 21 does not say anything about translating equity items to the presentation currency. If you use closing rate, then you can’t really reconcile CTD, but yes, you are right, all the differences would stay in the equity. S.

Dear Ms Silvia, Please explain necessary steps and consolidation process if subsidiary accounting year is different with parents…. example

Parent company accounting period 01/April to31 march.

but subsidiary accounting period 01/January to December

Hi, I am confused about handling the following Consolidation items 1. should Retained earnings (RE) from 1 year ago be retranslated at the closing rate each period? E.g

Financial y.end is 31/12/16

US RE for 2015 were $1000 @ 1.8 Closing rate 31/12/16 is 1.6

Should the $1000 earnings from 2015 be translated at $1.8 as they would have appeared in the 2015 consolidation? Likewise, with Intercompany balances (2 years old not settled), should the historic balances be left @ $1.8. I ask this because my auditor seems to just translate the current year movement and post the value to FCTR. In a previous role, all balances were translated at the closing rate (i.e 1.6 rather than 1.8) so i translate all balances. I’m confused because fo how the audit firm seem to treat the entry. And finally, I find when I translate the intercompany balances (historic and current year) to the closing rate there is always a difference to the Parent company balance. e.g creditor translated at closing rate is £100 but debtor balance is £90 in the Parent company. I assume this £10 should be posted to current year earnings. And, can I assume that the FCTR translation is calculated first and the £10 difference after. Thanks, Margaret

Hi Margaret,

1. No – please see above in the example. Retained earnings are reported at the historical rate.

2. Intercompany balances – as soon as they are not settled and still oustanding, you should translate all assets/liabilities with the current rate.

As for the difference – yes, it can happen and please revise the article for the explanation (about intragroup assets and liabilities).

Thanks, Sylvia. Have you come across companies translating RE at the closing rate as I have described? So intercompany should be translated at the current rate rather than the closing rate and the gain/loss be taken to the P&l rather than FCTR. The intercompany in question is the parent funding a branch for over 2 years. When transfer pricing kick-ins the debt will start to reduce, but I think it could take 2 years to clear. Does the current rate hold in that instance? I worked out the difference is because the parent incorrectly posted the original transaction in GBP so doesn’t have to re-translate each month. I was incorrectly putting the adjustment to the US entity. I believe it should go to the UK entity as the US entity is translated on a monthly basis and will have the correct valuation, i.e. closing or current.

Hi Silvia, Can you explain how to reconcile the movement of inventories provision when consolidating foreign subsidiaries between P&L and Balance Sheet? Eg: Rates are given below:-

Last year’s closing rate = 0.75

This year’s closing rate = 0.74

Current Average rate = 0.72 Balance Sheet:-

Opening provisions @ last year’s closing rate = 1000 x 0.75 =750

Closing Provisions @ this year’s closing rate = 800 x 0.74 =592

——————-

Balance Sheet Movements = 200 =158 Income Statement (COGS):

Current movement of provisions @ average rate = 200 x 0.72 = 144 ==> Movement from Balance sheet is $158 but appears in P&L is $144.

==> Should I reconcile the different of $14 as impact from foreign exchange translation? Appreciate your advise. Thanks.

Hello silvia, iam a new subscriber, could you please assist me more practical examples of foreign currency tranlation and conversions, i will appreciate please.Thanks

Fernando Maroni October 16, 2017 at 7:06 amHi Silvia, I am reviewing US GAAP foreign currency accounting policy and I have some questions. Could you please help me? Let´s suppouse the parent company (USA Inc) is a US company, located in the USA, and its reporting “or presentation” currency is the US dollar. USA Inc is the owner of Argentina SA, a subsidiary company located in South America. As you may know, determining if remeasurement or translation is necessary under US GAAP depends, (among other matters), on how the subsidiary company prepares its financial statements. If they are prepared in US dollars, no remeasurement, nor translation needs to be done by the US company to consolidate its financial statements. If the subsidiary prepares its financial statements in a currency different from its functional currency, those statements need to be remeasured to its functinal currency. Once the subsidiary company statements were remeasured to functional currency, they need to be translated to the reporting currency (in this case USD). But here come the questions… if this Latin American company decides to prepare its financial statements in both currencies (US and local entity currency), can the US Company use the USD statements of the subsidiary to consolidate? Is it generally accepted that a subsidiary prepares its financial statements in two different currencies? In this case it would be one for the parent company, intended to report to the management in USA using USD, and the other in local currency for local statutory presentation in the subsidiary country. Can both financial statements be prepared, or should the local one be remeasured and/or translated to the US dollar for consolidating purposes of the parent company? Thank you!

Regards,

Fernando

Hi Excellent article. Just a quick question, are the foreign exchange differences in the parent company relating to intra group loans with those entities subsequently consolidated also recognised to OCI in both the unconsolidated and consolidated statements? Thanks

thanks a lot. The explanation and the practical case study is awesome.

– i have a question in the case study, shouldn’t we calculate the intra-group transaction effect on COGS?.

– could you please make further expatiation on temporal method of consolidation and the circumstances to use this method. maybe this needs a separate article.

Hi Silvia,

I heard under equity method of investment parent investment should agree with subsidiary’s net equity.

My question is equity in subsidiary is included with forex reserve or excluded with forex reserve. Kindly explain me.

Hi! Could you please explain how you get 12 451 GBP for profit 2016

though no rate are mentioned as initial profit are in EUR for 15 000 Thanks in advance!

It is just the sum of operating profit and income tax expense as shown in the translated Profit and Loss statement below statement of financial position.

Hello Silvia, Could you please help me with the following issue:

The company A (functional currency – USD) has two foreign subsidiaries, B (EUR) and C (GBP). The presentation currency is USD.

Companies B and C trade with each other, and have outstanding intragroup receivables and payables as at the year end amounting to 10,000 EUR. Say, the rates are as follows 1 EUR = 0,85 GBP

1 EUR = 1,10 USD

1 GBP = 1,25 USD Company B recorded in it’s balance sheet a receivable amounting to 10,000 EUR, which is translated into 11,000 USD.

Company C recorded in it’s balance sheet a payable amounting to 10,000*0,85=8,500 GBP, which is translated into 10,625 USD.

When I try to eliminate them against each other I have to recognize a loss amounting to 11,000-10,625=375. It results from the difference between the “direct” exchange rate (1,1) and the exchange rate calculated with a reference to the third rate (0,85*1,25=1,0625). I understand that in a perfect world there should be no such differences, but the currencies in question are not actually USD, EUR and GBP and are not freely convertible, and a possibility for arbitrage exists.

The question is – where does this difference (375) go in the consolidated FS? Is it a FOREX loss in PL or a translation difference in OCI? The amounts are material so I can’t just ignore the issue, but I can’t find an answer anywhere. I would be very grateful for your help.

Hi Silvia , Thanks for proving very much useful topic. Requesting you to please provide me a excel template , if available, for the consolidation of foreign currency subsidiaries. Regards

Srinivas

Silvia, could you please give an example on IFRS 16: Leases which means how we can treat the prepayment for three years of building rent under lessee transaction and if you can please give detail examples of IFRS 16 as lessee and lessor. Thank you alot!

That’s off topic here. But, maybe in the future. S. E. Franklin November 1, 2020 at 3:15 amHi Silvia, another fantastic article indeed! However, could you please clarify if the CTD should be directly parked in Equity or it needs to be taken through Other Comprehensive Income? The relevant section from the standard is quoted below; Quote

“Translation from the functional currency to the presentation currency

The results and financial position of an entity whose functional currency is not the currency of a hyperinflationary economy are translated into a different presentation currency using the following procedures: [IAS 21.39] assets and liabilities for each balance sheet presented (including comparatives) are translated at the closing rate at the date of that balance sheet. This would include any goodwill arising on the acquisition of a foreign operation and any fair value adjustments to the carrying amounts of assets and liabilities arising on the acquisition of that foreign operation are treated as part of the assets and liabilities of the foreign operation [IAS 21.47]; income and expenses for each income statement (including comparatives) are translated at exchange rates at the dates of the transactions; and all resulting exchange differences are recognised in “other comprehensive income.”” End Quote.

Current year exchange gains or losses on the translation of an overseas subsidiary and its goodwill are recorded in other comprehensive income

Thank you Silvia about your article. Very usefull. One question: for equity method in individual financial statements whe should use the same procedures as used for consolidation purposes, correct? Thank you again.

Hi Luis, exactly. The same rules for foreign currency translation apply for associates and joint ventures. S.

Husna Fatima April 22, 2021 at 5:59 amThanks Silvia. In the example for Consolidation of Foreign subsidiary, intragroup sales of 5000 has been translated using exchange rate of the transaction date but related cost of sales 4500 has been kept at average rate due to which unrealized profit of 426 could not be eliminated. Please explain.

There is no element of unrealizable profits on it,they only gave inter coy sales which was deducted from revenue and cost of sales,it will have been diff if it was sold at cost plus, that is when we can realize profit

Sylvia, Weldome ma. You said doing the differences in balance isn’t correct.But I don’t get how we will balance the cashflow based on the proposed method. Also how is the foreign currency translation treated on the cashflow since all we have is average rates from both the parent and the subsidiary. Please I don’t really get this. I think you need to give examples or practical illustrative to make it sink better. Thanks great job

Dear Abdul,

yes, I understood that the forex cash flows is something more difficult, so I promise, I’ll upload some article with the example the next time. S.

Silvia, could you please give an example how to eliminate the intragroup transactions out of the aggregate cash flows? By the way,the statement of cash flows here refers to which method, direct or indirect? Thanks alot!

Hi Fairuz,

the cash flow statement here refers to either method. It applies for both, but it’s truth that it’s maybe a bit easier to make cash flows by direct method in this case.

How to eliminate intragroup? In a very similar way as in the profit or loss statement. So for example, imagine a subsidiary paid 5 000 CU to a parent for the goods. Then, the adjustment to eliminate would be to deduct 5 000 CU from both cash received from customers and cash paid to suppliers (if done by direct method). In a case of indirect method, you need to think carefully in which items there are intragroup balances open in the operating part. E.g. if there were no intragroup balances in the opening and closing receivables and payables, then no adjustment is necessary as for the change in working capital.

This is quite a complex question and deserves a separate article. I’ll do so in the future 🙂 S.